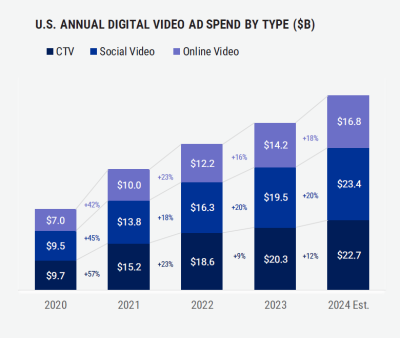

Advertising spend on connected TV platforms in the U.S soared to a record $20 billion in 2023 and is anticipated to hit $22.7 billion this year, representing 12% growth, as money follows viewers in continuing to switch from linear TV. That would make the CTV market 35% larger than that of online video (OLV) in 2024 according to the IAB’s latest annual Digital Video Ad Spend & Strategy Report.

Its figures also show that advertisers value social media equally if not more than CTV as spend on social video is expected to rise 20% for the second successive year to $23.4 billion in 2024.

All digital categories are rising with the tide as digital video, and CTV and social video in particular, continue to be the top channels for advertisers looking to reach engaged audiences at scale across the purchase funnel.

Total digital video ad spend across CTV, social, and online is projected to grow 16% this year — nearly 80% faster than total media overall – as combined spending is estimated to reach $62.9 billion, per the IAB report.

Digital video in 2024 is projected to have a 52% share of the total market for ad dollars over linear TV, surpassing the latter as share has shifted nearly 20 percentage points to digital video form linear TV in the last four years.

While dollars flowing into CTV primarily come from reallocations – particularly linear TV and other traditional media —31% of revenues come from overall expansion of advertising budgets.

“Among the largest ad spenders, CTV (69%) and social video (70%) are considered ‘must buys’ because of their ability to deliver both scale for branding at the top of the funnel and performance outcomes at the bottom of the funnel,” said Chris Bruderle, VP of Industry Insights & Content Strategy at IAB, in a statement.

Per a 2024 Advertiser Perceptions’ study quoted by the IAB, a third of advertisers identify their “general digital budgets” as a key funding source for CTV.

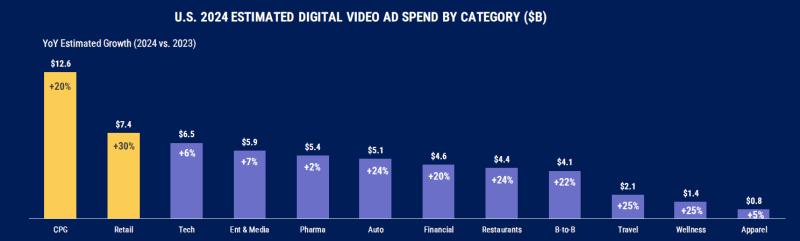

This year’s report also finds that most brand categories are projecting double-digit growth year on year with consumer packaged goods (CPG) and retail leading the way. Both CPG and retail digital video ad spend are expected to grow at 20% and 30% respectively, while also generating the largest total ad spend.

The report concludes that CTV and social video continue to be valued as audience-addressable channels that deliver both scale for branding at the top of the funnel and performance outcomes at the bottom of the funnel.

“Advertisers go where consumers are, and today that means digital video,” said David Cohen, CEO, IAB. “The challenge ahead is this: in a crowded landscape, who can deliver the best viewing experience, with the best content choices and the most innovative advertising options? That competition is ultimately good for consumers and good for the industry.”

The IAB partnered with Guideline which leveraged ad billing data, other market estimates and an IAB -commissioned Advertiser Perceptions quantitative survey of TV/digital video ad spend decision -makers to generate the results.

A second part of the report, to be released on July 15th, will address strategies driving activation and measurement.