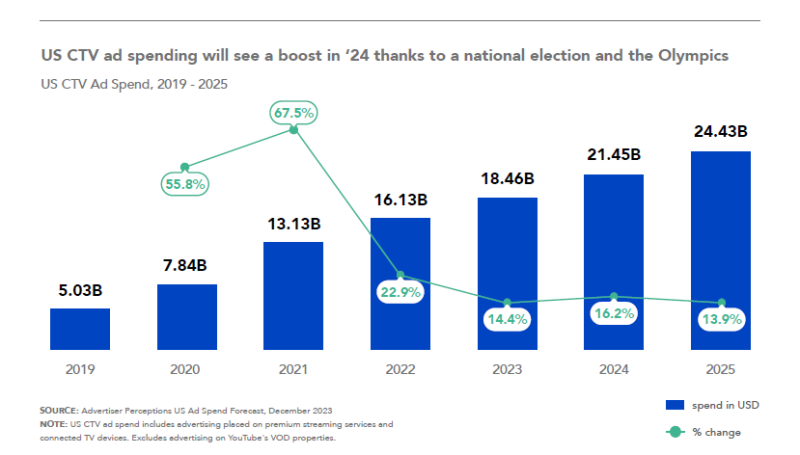

A new forecast from Advertiser Perceptions projects 16.2% U.S. ad spend growth for connected TV in 2024, boosted by political advertising and the Olympics. However, while still one of the fastest-growing media channels in the U.S., CTV faces competition for ad dollars from social media, where marketers are expected to keep investing against short-form video formats.

Advertiser Perceptions (AP)’s inaugural quarterly U.S. Advertising Market Outlook report found the growth rate for CTV ad spend slowed in 2023 compared to prior years but was still up more than 14% to $18.46 billion. In 2024 that’s expected to expand further to reach $21.45 billion in U.S. CTV ad spend this year, including advertising placed on premium streaming services and CTV devices (but excluding YouTube’s video on-demand properties). The firm attributed slower 2023 growth to a lack of U.S. elections and biannual sporting events – both of which will help increase spending on the channel in 2024 with a presidential election cycle and Summer Olympics.

The report noted competition for ad dollars in the CTV market “remains extremely strong” – where advertisers continue to shift budgets between streamers, while indicating they’re not planning to incorporate additional streaming services into media plans.

AP said its forecasts for CTV spend are conservative and the report included a couple of scenarios that could see growth outpace expectations. As it relates to political spending, AP’s projections expect most ad spend to stay within local TV channels and digital formats such as social media and search.

“If political advertisers decide to focus their persuasion and get out the vote efforts more heavily than we expect on younger and middle-aged voters, ad supported CTV will be a key beneficiary,” wrote report author and forecaster Eric Haggstrom, director of Business Intelligence at Advertiser Perceptions.

Another caveat is the entrance of Amazon Prime Video into the ad-supported streaming sphere. Ads launched on Prime Video at the end of January and AP said its forecast isn’t working under the assumption that the move will deliver significant incremental ad dollars to streaming in 2024. The firm expects most budgets allocated to Prime Video in the first half of 2024 will come from those that were already allocated for Amazon’s other streaming properties – or will compete for dollars from other streaming services. It also cited a continued weak scatter market as a major headwind for Amazon and other players through the first six months of 2024.

“In the long run, we believe Amazon will be able to draw incremental streaming budgets from SMBs that sell on their platform, but we expect minimal contribution in 2024. These assumptions could be quickly disproven in the coming months but expect heavy competition for streaming ad budgets that will grow at a moderate rate in 2024,” wrote Haggstrom.

Competition from social short-form video

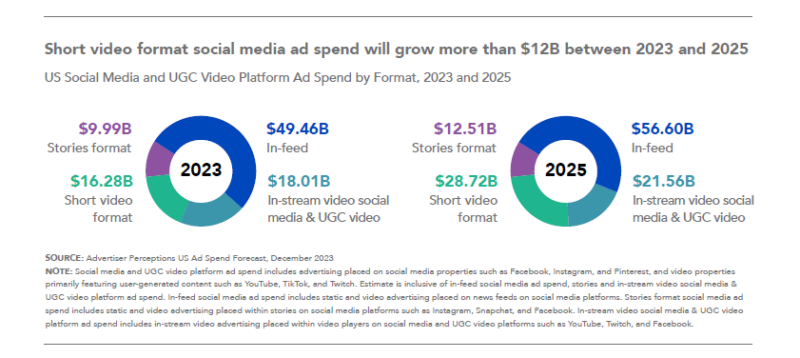

The report also highlighted that CTV streamers aren’t only competing against each other but with social media platforms, where most content is now in video form.

In 2023 social media and user-generated video platforms saw ad spend grow 14.6% over the year prior to reach $93.8 billion and outpace search engines “to become the largest individual ad channel in the US.”

The firm found “almost all growth” in social media ad spend in 2023 came from short-form videos like those on TikTok, Instagram Reels and YouTube Shorts. It expects that format to also largely fuel the 14% total growth projected for social media ad spend in 2024. In 2025 the short form video format is expected to capture $28.72 billion in ad spend, up from $16.28 billion in 2023.

Retail media keeps growing

A third channel bolstering digital ad spend in the U.S. is retail media, which grew nearly 32% in 2023 to reach nearly $50 billion.

“For context, that’s similar to the total amount US advertisers spend on national and local linear TV,” the report noted.

This year, the firm expects retail media ad spend to surpass $81.6 billion, representing 23.5% of all digital advertising in the U.S.

Retail media includes on-site search on retail websites and apps and on-site display, typically placed on retail websites and apps. However, spend on offsite channels – defined as advertising bought through a retailer-owned tech platform or that includes retailer-specific data bought through a third party and placed on third-party platforms – to make a splash in 2024. AP said that in 2022 retail media on owned and operated (O&O) properties accounted for over 90% of the category, but in 2023 offsite programmatic retail media platforms accounted for 15% of the category. And that’s expected to expand further.

“Specifically, we forecast over $20B in spend on offsite programmatic retail media advertising next year, up from $7.5B in 2023,” said Advertiser Perceptions in the report. “This will represent half of the programmatic market next year and a key revenue source for publishers of all sizes.”

Retail media has opportunities in the CTV space and vice versa, where advertisers can marry retail and viewing data for targeting, along with measurement and the potential for closed-loop attribution with the advent of new formats like shoppable ads.

“Brands have been pouring money into retail media over the past few years,” said Haggstrom in a statement. “While we expect this trend to continue, retail media will evolve significantly in the coming years. As ad auctions on retailers’ own properties become saturated, brands will look to utilize retailers’ data to power their buys outside of retailers’ digital walls. Media and ad tech companies need to form relationships with retail media platforms or risk missing out on one of the few large and quickly growing segments of the digital advertising market.”

Speaking at Advertising Week New York last fall, Ami Lathia, director of Off-Platform Ad Products at Target’s retail media business Roundel, called CTV “the rising star” of retail media. She cited three primary reasons for leveraging CTV in retail media, including CTV as providing an additional high-attention touchpoint , more precise audience targeting and measurement, and the ability to use the same audience not only for CTV but across a client’s entire digital media strategy.

“Thereby you can help push your consumers further down into the conversion funnel," Lathia said in October. “All in all I would say a win-win situation and why we are seeing more clients turn to CTV as part of the marketing mix, and to truly deepen that connection with our guests.”

Others have struck partnerships such as Roku, which last year teamed up with Best Buy to share data and serve better targeted ads on the streaming platform, as well as grocer Kroger, among others.

Walmart could also soon be in a position to compete more heavily at the intersection of retail media and CTV with its proposed $2.3 billion acquisition of smart TV maker Vizio.

Taken together, retail media, social media and CTV were the fastest growing channels within the digital ad market in 2023 where total US spending reached $283 billion, according to the report. Advertiser Perceptions expects total U.S. digital ad spend to continue to grow at a roughly 10% rate in both 2024 and 2025, with around $30 billion in incremental spend each year.