New data from ad intelligence platform MediaRadar shows the top six ad-supported streaming services collectively garnered over $1 billion in ad spend during the first 10 months of the year – but that figure represents an 8% year over year decline from the same time last year.

MediaRadar analyzed U.S. ad spend from the following six OTT ad-supported streaming services from January 1, 2022 through October 31, 2023: Warner Bros. Discovery’s Discovery+ and Max, Disney’s Hulu, Paramount Global’s Paramount+ and free ad-supported streaming TV (FAST) service Pluto TV, and NBCUniversal’s Peacock. From January to October 2023 advertisers invested nearly $1.07 billion in those six platforms – marking an 8% year over year decline from the $1.2 billion spent over the same period in 2022.

MediaRadar identifies the top six services based on ad spend, and Netflix and Disney+ - which are relative newcomers to the ad-supported game - were not tracked, nor were Fox’s Tubi or The Roku Channel FAST services. Smart TV players with ad-supported streaming services like Samsung, Vizio and LG also weren’t included in the analysis.

In a statement, Todd Krizelman, CEO of MediaRadar, cited challenges facing streaming services as evidenced by the drop in ad spend.

“Streaming platforms are confronting steep hurdles around ballooning content expenses, password sharing dilution, and an uncertain economic climate. These factors are fueling downstream subscriber and advertising adversities across the industry,” Krizelman stated.

Still, he noted “the streaming ad market also shows promise” as those six services alone attracted over $1 billion in spend in the period.

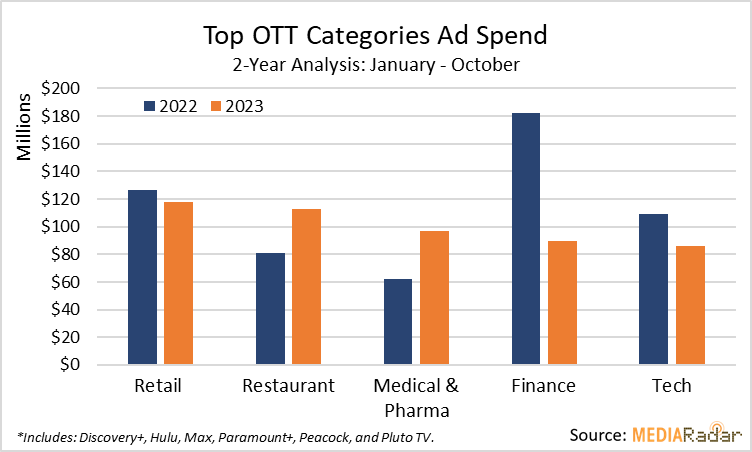

The top five advertising categories of retail, restaurant, medical & pharma, finance, and tech accounted for nearly half (47%), or $503 million, of the total ad spend through October. Collectively, those categories decreased spending 10% year over year. Of those five, the finance category saw the most marked decrease – driven by lower spending from insurance companies.

Finance constitutes financial institutions, real estate and insurance providers. Insurance providers contributed 68% to the finance category through Q3 2022 but that percentage dropped steeply to 36% in 2023. Leading insurance companies like Geico, State Farm and Progressive cut their OTT spending from $123 million last year to $32.5 million through this October, representing a 74% yoy drop.

The only two categories to increase ad spending on the OTT services were restaurants and pharma, which marked 39% and 56% yoy bumps, respectively.

Restaurants were a top category through Q3 2023 for Hulu, Paramount+ and Peacock, as quick service restaurants (QSR) in particular made more of a play on streaming. According to MediaRadar QSRs represented 74% of the category’s spend – jumping 38% as brands like McDonald’s, Taco Bell and Subway boosted their streaming ad investment.

“Quick service restaurants are making a strategic move by advertising heavily on streaming platforms,” said Krizelman. “With viewers at home, ads for restaurants are likely to prompt immediate orders, placing these brands right where viewers can act on them.”

Some streaming players have marked partnerships with food delivery services, such as an interactive and shoppable ad relationship between DoorDash and Roku earlier this year that serves up click-to-order offers within Roku ads for DoorDash merchants. Wendy’s was the first restaurant partner to sign on, offering discounts through ads on Roku’s platform.

Pharma meanwhile made moves and were particularly featured as Discovery+ and Peacock’s top categories. Pharma companies spent nearly $84 million on ad-supported OTT, marking a 66% spending boost yoy, including companies such as AbbVie and GlaxoSmithKline.

While retail and technology spend on streaming services dipped overall yoy, retail was still the top spending category so far in 2023 and both categories zeroed in on specific platforms where they made significant contributions.

Retail advertisers accounted for 14% of Discovery+ ad spend so far this year, with general retailers such as Target and Walmart accounting for 28% of the category. Retail also accounted for major contributions to Hulu (13%) and Pluto TV (12%), with MediaRadar calling out car dealerships as “dominating Pluto TV’s retail spending.”

On the technology side, telecommunications companies such as AT&T and T-Mobile led the category’s ad spending on Max. Technology advertisers made up 19% of Max’s ad spend through Q3 2023. Carriers accounted for 61%, followed by software vendors such as Adobe, Canva, and IBM (24%). Technology advertisers also turned to Paramount+, contributing 10% of the platform’s ad revenue and totaling over $15 million, led by spending from T-Mobile and Verizon.