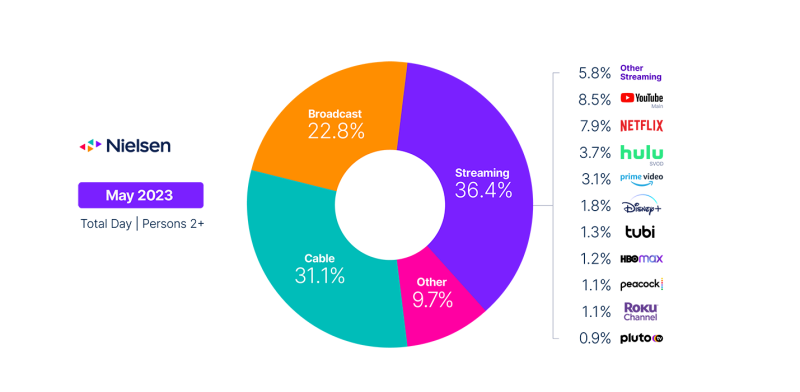

While May saw overall TV usage dip compared to April, streaming had a slight upswing per the Nielsen’s Gauge report – which for the first time officially included The Roku Channel as a standalone service, after the FAST surpassed the 1% threshold of total TV time.

The Roku Channel, Roku’s free ad-supported streaming TV (FAST) service, achieved a 1.1% share of TV usage in May, breaking it out of the “other streaming” category to claim its own spot in The Gauge report. It marks the third FAST to do so and follows Paramount’s Pluto TV and Fox’s Tubi, which each previously snagged the distinction.

The Gauge report pegged the Roku Channel’s breakout performance as highlighting the growing footprint of FAST services, which offer free content (both linear style channels and on-demand flavors) with ads, often without the need to sign up or in. Based on share of TV usage, The Roku Channel (1.1%), Pluto TV (0.9%) and Tubi (1.3%) are each comparable to the usage seen on major SVOD services Peacock (1.1% share of TV time in May), and HBO Max (1.2% share) – with Tubi actually slightly outpacing the other four in May. And together, the three FAST services account for more TV usage than Amazon Prime Video, which captured 3.1% share last month.

As of the first quarter Roku had 71.6 million active accounts, with The Roku Channel maintaining a top-five position among channels on the platform, both by active account reach and streaming hours.

Although several FASTs have burst onto the scene, including media company-owned FASTs, smart TV OEM services like Samsung TV Plus, Vizio WatchFree+, LG Channels and a variety of independent app publishers all getting in on the action, some players in the space have pointed out it’s still early innings of the ecosystem. Speaking at the StreamTV Show in Denver last week, panelists including from Allen Media Group, Chicken Soup for the Soul, Samsung and Wurl discussed challenges on FAST, specifically discoverability and advertising – with executives agreeing software-based customization and personalization potentially could serve as ways to address both.

As for TV viewing last month, overall, streaming continued to account for the largest portion of the TV usage pie in May, up 2.5% to 36.4%, again outpacing broadcast and cable. However, around half of the monthly bump in streaming usage was due to a change in methodology by The Gauge as it now credits viewing to streaming originals via cable set-top boxes to the streaming category, rather than its previous designation in the “other” category.

The methodology change also gave a boost to Netflix, driving roughly half of the platform’s monthly usage gain of 9.2%. Still, coupled with the SVOD having the top three streaming titles in May, Netflix still saw momentum and landed in the second spot for streaming with an almost 8% share. That still left it behind YouTube, which for the fourth month in a row kept its spot as the number one streaming platform, gaining 0.4 share points and accounting for 8.5% of TV (it’s worth noting that after a separate methodology change linear streaming from virtual MVPDs and MVPD streaming apps such as YouTube TV and Hulu + Live TV are no longer included in the streaming category.

Amazon Prime Video also saw usage increase, posting a 5.1% gain to grab just over 3% share of TV time.

Across the TV ecosystem, The Gauge blamed a 4.4% drop in total TV viewing in May by drops for tune-in on broadcast and cable, which saw respective viewing declines of 5.5% and 5.4%, and a 0.3 share point decrease each over the prior month. Per the report, declines on broadcast were largely driven by a 25% drop in sports viewing, though NBA Finals helped boost a 12% bump in cable sports viewership while news viewing was down 11%. Year-over-year declines for cable viewing hit double-digit percentages at 13.7%.

Last month also saw the start of a WGA-represented Hollywood writers’ strike, which has been ongoing since May 2 after contract negotiations with studios hit an impasse.