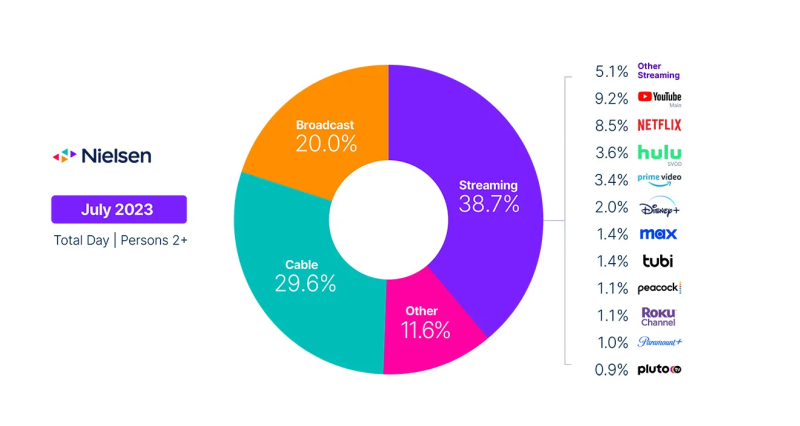

Overall TV usage ticked up slightly in July and streaming’s share of TV viewing hit new heights while cable and broadcast’s combined share dipped to hover just under 50% in Nielsen’s latest The Gauge monthly snapshot.

Streaming’s TV viewing share in July reached 38.7% while the “other” usage category grew to 11.6%, driven by video game consoles. Nielsen attributed streaming and “other” share gains to July trends that saw more usage by younger people. In July TV viewing among people under 18 climbed 4% but viewing by adults 18 years and older declined 0.3%

Still, streaming was the dominant TV viewing format for the month, as broadcast and cable dipped to 20% and 29.6% respectively. The shares mark new lows in The Gauge report for both broadcast and cable over the past two years. In July 2021 cable commanded a 37.7% share and broadcast had a 23.8% share – in July 2022 cable held a 34.4% share while broadcast captured 21.6%.

It’s almost a reversal for streaming, which had just a 28.3% share two years ago. However, the 2021 and 2022 figures came before Nielsen implemented a methodology change in February 2023, which was made so cable and broadcast categories now include viewing of that content via virtual MVPDs such as YouTube TV and Hulu + Live TV, as well as through MVPD apps. Before the change, linear streaming usage on vMVPDs and MVPD apps contributed to the streaming category – meaning prior years may not be a straight comparison and share declines for cable and broadcast compared to the past two years could be even more marked (although Nielsen did not break out specific contributions from vMVPDs).

For July 2023 cable viewing was down by one percentage point compared to June and usage was down 12.5% year over year, while broadcast usage declined 5.4% compared to a year ago.

Nielsen anticipates a seasonal shift as sports, particularly the NFL, return in the fall, but noted the potential loss for new primetime content, as the ongoing Hollywood actors and writers strike could impact cable and broadcast lineups.

On the streaming front YouTube continued to lead the pack in July, grabbing over 9% of TV viewing time for a new high, followed by Netflix above 8%. Hulu and Amazon Prime Video also marked share gains in July. Fox’s Tubi was the best performing FAST reported on the Gauge, with a share of 1.4% - equal to that of Max and ahead of SVODs Peacock and Paramount+.

Nielsen’s latest Gauge report follows the end of Q2, during which traditional linear TV providers and leading virtual MVPDs subscriber saw subscriber losses.

The top cable pay TV providers saw a net loss of around 925,000 video subscribers in Q2 for a total of 35.9 million, according to Leichtman Research Group. Other traditional pay TV providers including DirecTV, Dish and telcos Verizon and Frontier counted net losses of 690,000 for a total subscriber base of about 22.7 million as of the end of Q2.

Meanwhile, virtual MVPDs FuboTV and Disney’s Hulu + Live TV each reported sequential quarterly subscriber declines, losing around 118,000 and 100,000, respectively, while Dish’s Sling TV lost 97,000 net subscribers in the period. YouTube TV, the largest vMVPD gained an estimated 200,000 per Leichtman Research, for a base of 5.9 million. Collectively, leading vMVPDs had around 13.4 million subscribers as of the end of Q2.

The research firm estimates the total pay TV base for top providers, including vMVPDs, now stands around 71.9 million subscribers.

“Pay-TV net losses of about 1.73 million in 2Q 2023 were similar to the losses in last year’s second quarter,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, in a statement. “Over the past year, top pay-TV providers had a net loss of about 5,360,000 subscribers, compared to a net loss of about 4,235,000 over the prior year.”