The NFL season is underway amid what's expected to be another record year for online sports gambling. While bettors’ debate which team will win the Super Bowl this year, sports gambling companies gamble on who can grab the most market share. DraftKings (DKNG) and FanDuel are reported to have more than 75% of the market. Begging the question of whether consolidation for the other 25% is in the cards or if there is room for another player.

ESPN and PENN Entertainment (PENN) announced on August 8, 2023, that ESPN BET, an ESPN-branded sportsbook, will launch in the coming weeks or months prior to the start of the fall football season. However, it appears they missed kickoff weekend for the full branding funnel. ESPN BET will join an ever-growing gambling market that includes the likes of major sports betting companies like DraftKings, Caesars, FanDuel, BetMGM, and others.

ESPN BET will be available in 16 states where PENN currently offers mobile sports books. PENN will pay ESPN $1.5 billion over the next 10 years and grants ESPN the option to purchase 31.8 million shares of PENN stock worth $500 million. The warrants will vest over the same 10-year period.

“This agreement with ESPN and collaboration on ESPN BET allows us to take another step forward as an industry leader. Together, we can utilize each other’s strengths to create the type of experience that existing and new bettors will expect from both companies, and we can’t wait to get started,” PENN CEO Jay Snowden stated, "Everyone in the world is familiar with the ESPN brand. There's a lot of affinity for that brand, and so we think that's going to be extremely complementary to what we've built over the course of the last three years."

“Our primary focus is always to serve sports fans and we know they want both betting content and the ability to place bets with less friction from within our products,” said Jimmy Pitaro, chairman of ESPN. “The strategy here is simple: to give fans what they’ve been requesting and expecting from ESPN. PENN Entertainment is the perfect partner to build an unmatched user experience for sports betting with ESPN BET.”

ESPN stated in the press release that it has increased its multi-platform sports wagering content in recent years by adding digital programming, radio segments, and editorial coverage from talent. ESPN's sports wagering content will be housed under the ESPN BET brand across all platforms. The Walt Disney Company also stated that it will use its platforms to educate sports fans on responsible gambling and will evaluate compliance and programming related to sports betting on a regular basis.

Disney also is reported to be seeking strategic partners for the ESPN Network’s eventual shift to a direct-to-consumer streaming service. If the linear network transfers to a foundational service provider like Amazon, then Penn Entertainment and ESPN BET will only benefit. At the time of this article's publication, neither Disney, ESPN, Amazon, nor PENN have commented on what would happen to ESPN BET if the ESPN linear network moved inside another streaming service.

Although fan engagement activities have evolved beyond wagering, sports content providers continue to rely on "lean-in" experiences to maintain audience interest. ESPN developed the Bottom-Line graphics program in April 2003 to display current sports scores, statistics, and headlines in a "push-and-scroll" fashion during live sporting events. Now, ESPN intends to maximize its content offering by combining it with real-time wagering on sporting events broadcast on ESPN/ABC.

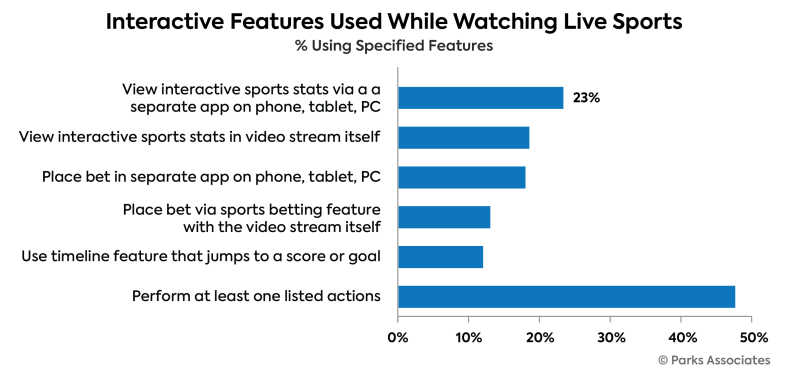

As a result of streaming, content providers can deliver real-time engagement with the sports content that viewers are seeing. The appetite among sports fans for more statistics, data, and opportunities to participate in their favorite sport's or team’s activities remains strong — in 2022 48% of households who watch live sports participated in at least one interactive activity while watching and 18% said they placed a wager.

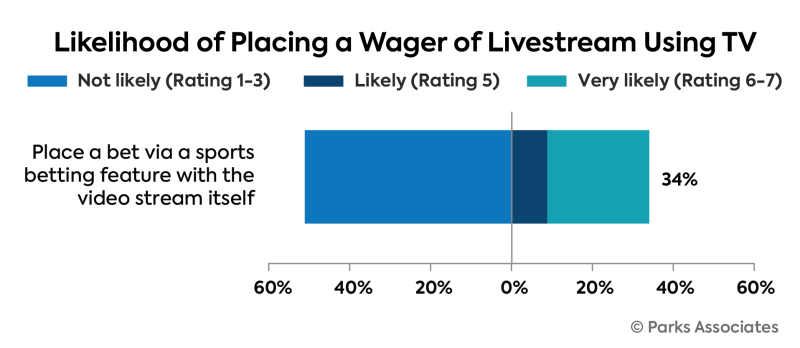

However, mistrust still exists about live sports betting. While placing a live wager on the next play, touchdown, or goal may be the ultimate gambling experience, in 2022 many fans were wary of the delay, bit rates, bandwidth, and encoders of streaming services. These issues may not allow all viewers to see the same live action in real-time as those viewing in person.

Parks Associates research shows only 13% of broadband households actually placed a wager within the video stream they were watching. Today many of these technology concerns have seen tremendous improvement. Nonetheless, this distrust may have contributed to the 51% of consumers who were not willing to place a wager on content they were watching via streaming.

PENN Entertainment may have discovered the ideal partner in ESPN. ESPN's eight cable networks and ESPN on ABC will benefit PENN. ESPN's extensive sports media rights, which cover the NFL, NBA, MLB, NHL, college football, and many others, present the ideal opportunity for wagering interactions on the large screen. This type of interactivity could give ESPN BET a competitive advantage.

Eric Sorensen is a Director, Streaming Video Tracker, for Parks Associates, a market research and consulting company. He is an accomplished sports and news media executive with extensive knowledge in developing live streaming and Digital Media strategies. Eric spent over 15 years at ESPN helping pioneer the launch of WatchESPN, The Longhorn Network, and SEC digital network. Prior to joining Parks Associates Eric served as Director of Advertising and Digital and Social Content for the Houston Astros.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by StreamTV Insider staff. They do not represent the opinions of StreamTV Insider.