There is no question, connected TV has fundamentally changed how viewers access TV content. We all intuitively know it, but here are a few data points to illustrate just how significant the shift has been:

- In TVision’s latest The State of CTV report, we shared that more than 83% of all US households are CTV enabled, with the average household accessing 7.3 apps.

- As reported in the TVision Signal, our weekly look at CTV viewing trends, more than 55% of households watched both streaming and linear TV in April 2023.

- Also illustrated in the TVision Signal, FAST apps and ad-supported subscription tiers for non-FAST apps are the fastest growing categories of CTV, with pure SVOD apps capturing just 7% of time spent viewing in April 2023.

All these trends together indicate that CTV is now synonymous with television. Viewers are no longer making a distinction between linear and CTV content. In fact, they are also increasingly willing to accept broadcast-like advertising experiences on CTV. So why are media sellers and advertisers still operating as if they are two fundamentally different types of media?

CTV program measurement takes a step forward

One of the main problems is lack of transparency across the CTV landscape. Before the industry can effectively value CTV inventory in comparison to linear, we must be able to measure and benchmark performance regardless of platform. For instance, Linear TV buys often revolve around premium programming, but program measurement in CTV is particularly challenging.

To start with, many CTV apps act as walled gardens, and have been able to grow revenue and steal market share without providing program-level transparency to their advertisers. In fact, CTV apps often cite privacy laws limiting the use of viewership data as a reason not to share program-level data, but at the same time also resist privacy-safe methods of sharing this data with ACR and other vendors. For instance, when negotiating with smart TV manufacturers who want to include their app, CTV apps use their leverage to limit ACR and other measurement capabilities, even if it was only to be used in aggregated post-campaign reporting. Likewise, CTV apps will not pass program data through the bid stream to advertisers.

While lack of transparency into program viewership certainly makes it much easier to monetize low-quality inventory, it also makes it much harder to justify premium value for high-quality inventory. For publishers who are still trying to win the streaming wars by producing high-quality content that attracts more viewers, this presents a significant missed opportunity. I’d argue that both buyers and sellers would benefit from knowing more about what content is best engaging audiences, and where ads are being delivered.

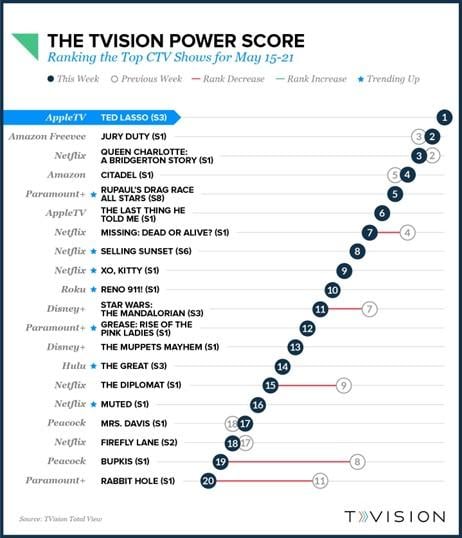

This is one of the many CTV challenges that TVision is focused on solving. Because we measure every second of TV viewing via a privacy-safe opt-in panel, we are able to provide insight into program engagement across the entire CTV landscape, as well as linear. To help the industry better gauge CTV program performance, we’ve recently introduced the TVision Power Score, a simple ranking of the top 20 CTV programs.

For example, just how should the market value “Jury Duty” on Amazon Freevee? Freevee is a smaller app that may fly under the radar for many marketers, but its breakaway hit "Jury Duty" suggests marketers should be interested. The show took the second spot on our TVision Power Score for the week ending May 21, its third week ranked as the top 3 performing CTV show. In terms of quality engagement, it beat mega-hits like “The Mandalorian” from Disney+ and held its own with the latest Bridgerton tale “Queen Charlotte” from Netflix. The TVision Power Score factors in four key metrics: the amount of time viewers pay attention to the program, the amount of program time available for the season, the program’s reach, as well as the application’s reach. It’s a good indicator that a show like "Jury Duty" may be an excellent opportunity for marketers where they would be guaranteed to reach a highly engaged audience.

Attention is a cross-media metric

With direct comparisons of programming across apps now possible, the next hurdle to address is comparisons between CTV and linear. Despite fairly seamless viewer experiences, the systems for targeting and measuring linear and CTV media couldn’t be more different: its ratings vs. highly targeted addressable audiences, its daypart targeting vs. ads that run across all 24 hours of the day, its brand metrics vs. video completion rates, etc. But a common metric for comparisons is already available: Attention. Attention metrics, which detail how much time viewers spend with their eyes on the screen when ads and programs are aired, can provide equivalent benchmarks for performance across linear, CTV, and even digital channels.

TVision has been measuring and reporting on viewer attention to TV for years. It is notable that viewers don’t pay the same attention to everything they watch. Even if audiences are on target, programming still impacts attention, as does timing, ad placement and many other factors. All of these can become points of comparison that can help both buyers and sellers determine which media opportunities provide the most value - across both linear and CTV.

I firmly believe that while marketing and media sellers have different goals, both buyers and sellers benefit from the improved transparency that cross-media measurement delivers. Now with insight into performance across programming, pod position, ad length and more, even the media sales team at an emerging FAST or AVOD app can effectively position inventory against linear TV counterparts.

Yan is the CEO and Co-founder of TVision, the only company which measures how people really watch TV and CTV via a passive in home panel. TVision helps brands, their agencies, TV networks, and OTT platforms better understand how people really watch CTV so they can make more effective media decisions.

Yan founded TVision while earning his MBA at MIT. Prior to TVision, Yan started and managed Yo-ren, a leading digital marketing agency in China, and also worked at McKinsey in Tokyo. He has an MBA from the Massachusetts Institute of Technology (MIT), and a Bachelor of Industrial Engineering from the Tokyo Institute of Technology. He is an in-demand speaker, having appeared on stage at numerous industry events including Advertising Week, TV of Tomorrow, TV Week, as well as IAB, ANA and ARF events. Yan grew up in both Japan and China and currently resides with his family in New York.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.